The only thing that can be stated is that the company's growth rate is a determining factor in the level of NVIDIA multiples. Judging by the proposed multiples, I cannot make an unambiguous conclusion. The same is true for the EV/EBITDA multiple: But the quality of this model is not high enough:Ĭonsidering the EV/Revenue to growth multiple, NVIDIA seems expensive: This suggests that growth is a determining factor in the level of NVIDIA multiples.Ī comparative valuation of NVIDIA through the forward P/E (next FY) to growth multiple indicates that the company is undervalued by 18%. To my surprise, all of these models are based on growth-adjusted multiples. As a result, I found only three models that allow a more or less reasonable judgment of the relative value of the company. Using elements of machine learning, I analyzed many options for comparative assessment of NVIDIA through multiples. And the nearest forecast also does not justify the current price of the company. Under this approach, NVIDIA's modeled capitalization is lower than the actual one within about two standard deviations. So, having determined that revenue is a key driver of company capitalization, we can build a general model that determines the company's balanced price: But more importantly, the expectation of a decrease in the revenue growth rate indicates a potential decrease in the P/S multiple in the coming quarters. In the context of the last model, the company is now also overvalued. In my opinion, this means that the rate of revenue growth is now a key driver of capitalization. It should be noted that there is no similar qualitative relationship between EPS and earnings growth rate. On the other side, over the past seven years, NVIDIA has shown a direct relationship between the rate of revenue growth and its P/S multiple. The same is true for the relationship based on the EPS TTM absolute size: As a rule, this allows you to identify persistent regressions.īased on the long-term relationship between the revenue TTM absolute size and the company's capitalization, NVIDIA's current price is somewhat overvalued:

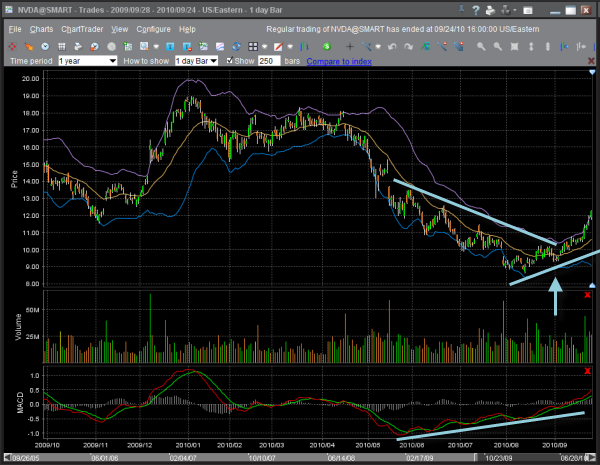

The easiest way to get a first idea of the adequacy of the company's current price is to look at the dynamics of its capitalization in the context of the dynamics of key results.

Therefore, at this stage, I offer a comprehensive, quantitative analysis of the company's fundamental value. I readily admit that I do not fully understand the specifics of the company and what investors see hidden in it.

This is my first article about NVIDIA (NASDAQ: NASDAQ: NVDA).

0 kommentar(er)

0 kommentar(er)